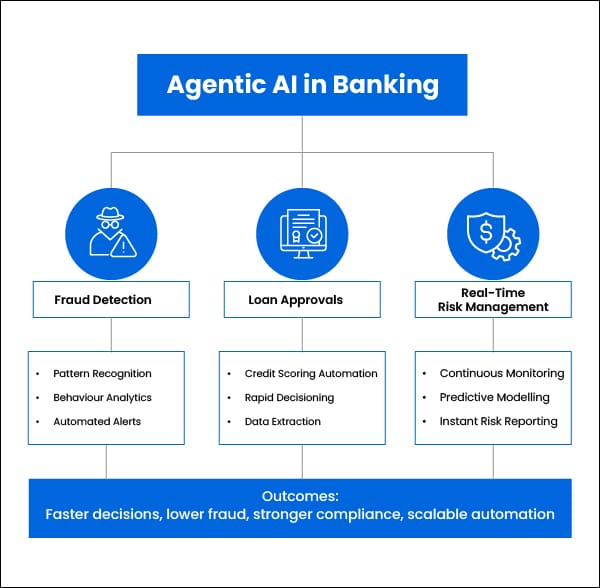

Banks are under pressure to move faster while staying secure and compliant. Traditional AI has helped, but the next leap requires systems that can adapt on their own. Agentic AI brings that capability. It analyzes behavior in real time, makes decisions without waiting for human intervention, and continuously learns from new patterns. For financial institutions, this means stronger protection, faster lending, and more proactive risk management.

Agentic AI is now shaping the way financial institutions and fintechs operate. Deloitte forecasts that by 2027, half of Gen AI adopters will shift to Agentic AI, which signals a decisive move toward systems that can sense, decide, and act with limited human intervention.

Banks are exploring this shift not simply to automate tasks, but to strengthen decision-making, minimize fraud, accelerate credit access, and improve resilience in a landscape where risks evolve by the hour. Seen through a strategic lens, agentic AI is becoming the foundation of intelligent banking ecosystems.

Rethinking Banking Resilience

Let’s face it. Fraud has become one of the biggest threats to financial stability. Credential stuffing, synthetic identities, deepfake impersonations, and crime as a service have made legacy fraud controls inadequate. Traditional engines rely heavily on rule-based checks and siloed scoring models. They often delay detection, escalate false positives, and frustrate both teams and customers.

Industry numbers convey the urgency. Banking fraud losses are projected to exceed $45 billion in 2024–2025, fueled by increasingly sophisticated attacks. The Alloy 2025 State of Fraud Report found that 60% of financial institutions and fintechs reported an increase in fraud attacks year on year. A report by SEON Ltd. places worldwide fraud costs at around US $5.13 trillion annually, showing a steep rise of around 56 % over the past decade. This reality demands a different approach, one that moves from reactive protection to proactive intelligence.

Agentic AI introduces that shift by combining autonomous analysis, context awareness, and continuous learning.

With fraud mitigation becoming more complex, banks are recognizing that they cannot protect customers with yesterday’s tools. This is where the agentic model creates meaningful impact.

Agentic AI Reinvents Fraud Detection

Agentic AI applies advanced pattern recognition, behavior modelling, and real-time analytics to detect anomalies in seconds. At a strategic level, this matters for three reasons.

First, it closes the reaction gap.

Fraudsters adapt faster than traditional risk models. Agentic systems learn from live behavior, not just historical data. This allows them to act before a suspicious pattern becomes an actual loss.

Second, it reduces operational friction.

Banks often suffer from high false positives, which strain investigation teams and disrupt customers. With contextual intelligence, agentic models filter out noise and highlight the most critical threats.

Third, it enhances customer trust.

A bank that protects its customers in real time secures long-term loyalty. Faster detection reduces incident severity and the average cost per breach.

Many banks that implemented agentic fraud engines have reported close to 28 percent fewer successful scams and identity fraud attempts. This demonstrates a measurable business case, not just a technical upgrade.

Fraud detection may be the most visible use case, but the same intelligence applies across the credit lifecycle. The next leap is in how banks approve and process loans.

Fast-Tracking Loan Approvals

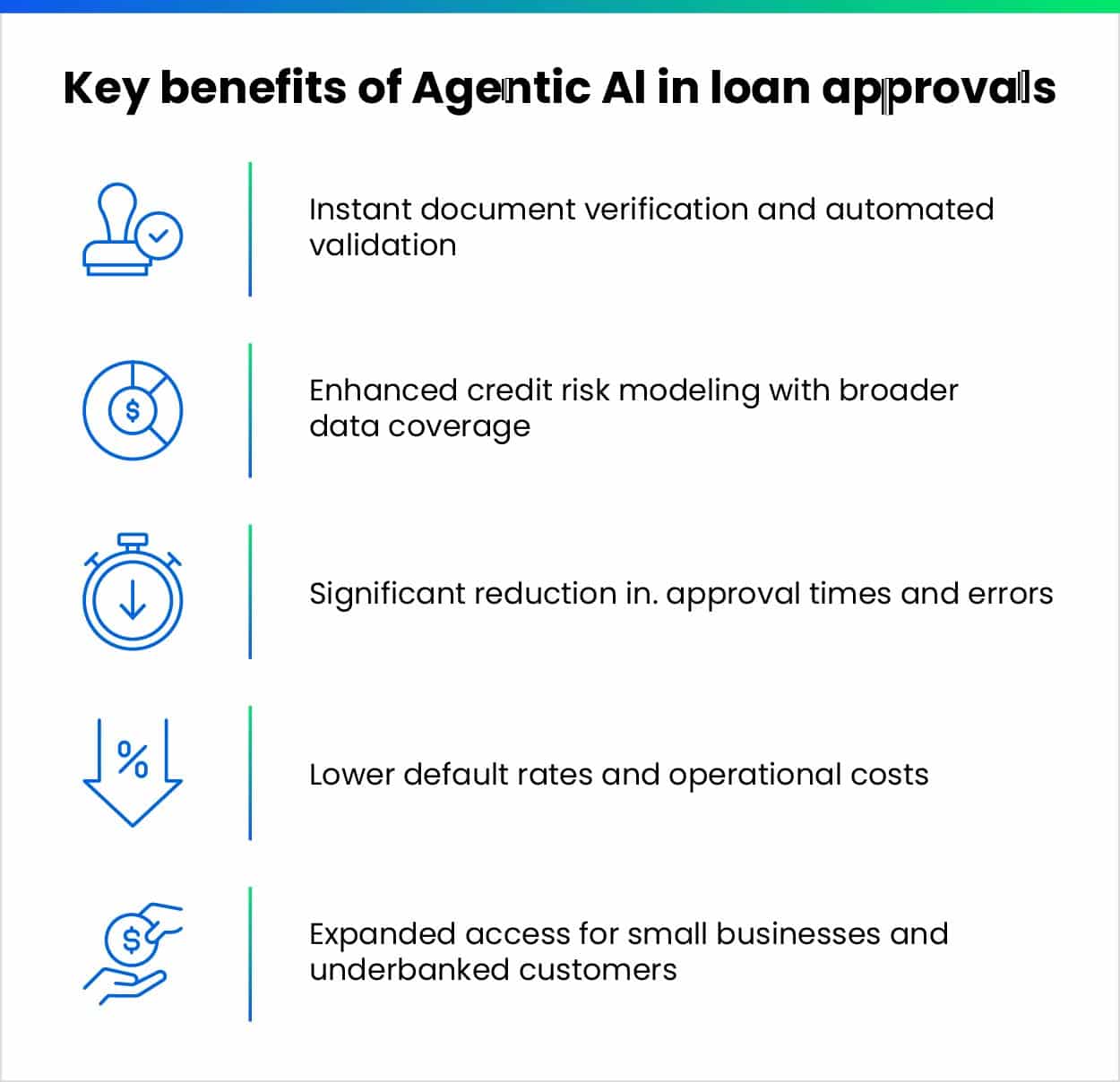

Loan approvals have traditionally been paperwork-heavy and time-consuming. Manual document checks scattered income proofs, inconsistent scoring, and dependency on credit officers often result in delayed decisions. For borrowers seeking immediate liquidity, especially small businesses and underserved segments, this delay becomes a barrier.

Automated document intelligence.

AI agents extract and verify data from bank statements, payslips, GST records, and business documents with higher accuracy than manual review.

Instant risk scoring.

Agentic systems evaluate repayment capacity using behavioural signals and contextual insights rather than relying on limited bureau data.

Higher inclusion.

Because agentic AI interprets non-traditional data more effectively, it expands credit access for customers who were earlier deemed “thin-file”.

The outcomes speak for themselves. Some lenders have brought down loan processing from two days to less than an hour. Others have improved decision accuracy and extended credit to nearly 22% more underserved borrowers.

While speed matters, sustainable lending also requires continuous risk visibility. This brings us to the third strategic advantage of agentic AI.

Real-Time Risk Management

Banks operate in an increasingly unpredictable financial climate, and this calls for continuous risk assessment to stay afloat. Market shifts, cyber threats, liquidity risks, and compliance events can emerge faster than manual reviews can respond. Traditional risk models were never designed for real-time recalibration.

Agentic AI supports a more predictive risk posture.

Continuous monitoring.

AI systems track millions of data points across transactions, customer behavior, credit exposure, and operational triggers. This reduces the reliance on periodic reviews.

Dynamic risk scoring.

Models adjust exposure based on new inputs rather than waiting for quarterly cycles. Banks respond to anomalies within seconds.

Operational efficiency.

Studies show that AI-enabled risk dashboards reduce manual effort by nearly half and accelerate suspicious activity reviews by up to eighty percent.

From a strategic standpoint, this shifts risk management from a reporting function to a real-time control tower. It improves audit readiness, strengthens compliance, and equips banks to make faster, informed decisions.

As powerful as these outcomes are, agentic AI also requires thoughtful adoption. Banks must navigate not only opportunity but also the responsibility that accompanies intelligent automation.

Navigating Challenges and Creating Long-Term Value

Agentic AI is on track to become the core of modern financial infrastructure. More than ninety percent of banks already use some form of AI-driven monitoring. Fraud losses have reduced, credit decisions have become faster, and risk response times have improved significantly.

Global forecasts indicate strong adoption. Deloitte estimates that half of AI-driven enterprises will deploy agentic models within two years. IDC projects more than 120 billion dollars in AI investment by financial institutions by 2030. As these models mature, they are expected to reduce operational costs, enhance regulatory reporting, and enable personalised financial products that can be launched in weeks instead of months.

Looking ahead, the institutions that succeed will be those that combine intelligence with accountability. Governance, algorithmic transparency, model monitoring, and ethical AI will become central to trust. This is not just a compliance requirement. It is a competitive differentiator.