In the financial services realm, traditional banking models have long been associated with lengthy processes, high fees, and limited accessibility. However, the emergence of fintech companies has disrupted this landscape, introducing innovative solutions that cater to the changing needs and expectations of customers.

Customer-centric strategies, once exclusive to major B2C players like Amazon and Google, are now reshaping the B2B digital customer experience, especially in banking.

Among these disruptors, Nubank, Latin America's largest fintech bank, has taken the region by storm with its digital-first approach. By offering faster, more affordable, and customer-centric products, Nubank has successfully attracted a growing base of customers who crave a modern banking experience.

Reports show that investing in digital customer experience technologies can boost revenue by 15% and reduce customer churn by 20%. Several banks have also observed that strong customer experience yields almost triple the revenue growth compared to competitors.

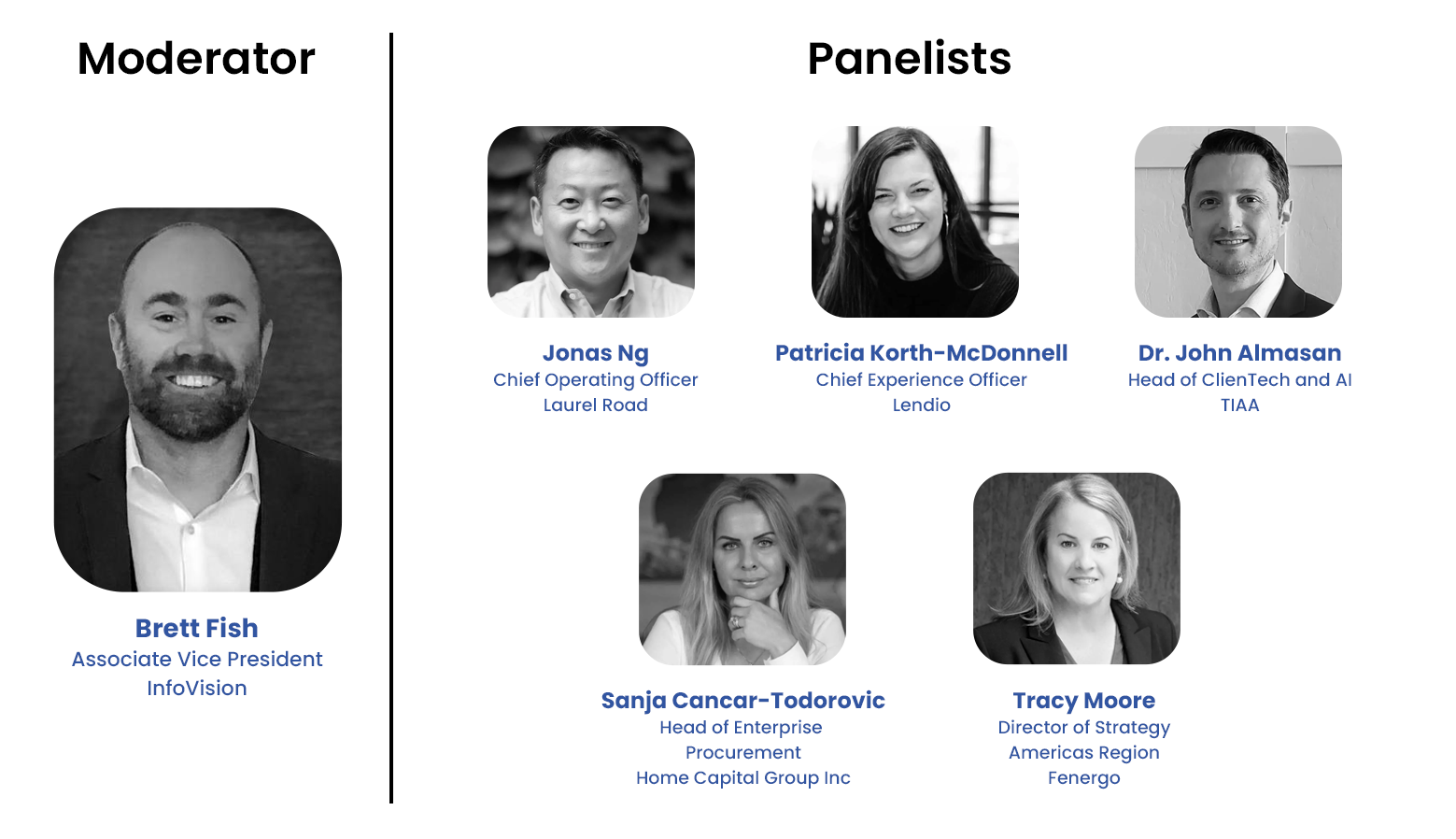

Curious to learn more about the banking customer's needs and expectations? Listen to this panel discussion featuring Associate Vice President of InfoVision, Mr. Brett Fish, and other esteemed professionals in the industry:

The panel discussion focused on the best ways to improve the banking customer experience and highlighted key trends to watch in digital banking customer experience.

Technology is revolutionizing the banking sector, propelling it toward a more digital, convenient, and secure future.

Mobile banking, digital currencies, AI, open banking, and cybersecurity are just a glimpse of the transformative power of digital technology in this industry. By embracing these innovations, banks can offer their customers exceptional experiences and gain a competitive edge in the market.

Revolutionize your financial institution by imbibing InfoVision’s transformative technologies and disruptive strategies, and connect with InfoVision by contacting us at the following: Contact Us | InfoVision

To explore personalized banking experiences that exceed customer expectations, we invite you to watch the video: